HUD has thousands of foreclosed homes for sale throughout the country. Here’s how you find HUD foreclosure listings and buy from them.

The U.S. Department of Housing and Urban Development (HUD) has thousands of foreclosed homes for sale throughout the country. To buy a HUD home, you first need to understand how to find HUD foreclosure listings and the buying process.

HUD foreclosure listings exist because homeowners defaulted on mortgages that were insured by the Federal Housing Administration (FHA). When this happens, the government pays the lender for the mortgage balance and takes possession of the home. These homes are placed on HUD foreclosure listings and resold on the HUD Home Store website.

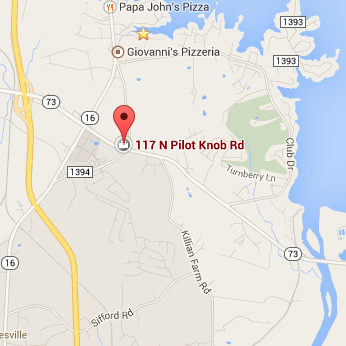

Compare foreclosure listings in Charlotte and Lake Norman, NC

HUD homes are considered real estate-owned (REO) properties, yet if you want to buy one, the process differs from buying an REO from a bank. The HUD Home Store lists all of the HUD single-family REOs for sale. You can shop these HUD foreclosure listings at your convenience. When you are ready to walk through a home, order a home inspection or place a bid, you will need to work with a HUD-approved real estate agent.

Our free guide on HUD homes explains the bidding process, the insurance rating for HUD homes and your financing options. Get it here.

You can buy a HUD home to live in or as a real estate investment, however, HUD gives preference to owner-occupants the first month the home is on HUD foreclosure listings. Once the priority period for owner-occupants has passed, bidding is opened up to everyone else. As you look at homes on the HUD Home Store site, you see a case number, property specifications and details about who is now eligible to bid on the home.

If you find a home that you’re interested in, you should get a professional inspection. HUD doesn’t offer warranties on the homes it sells, so a professional inspection discloses any problems with the property. As with many distressed properties, HUD homes might be in need of renovations due to neglect or due to the past homeowner’s inability to pay for repairs. It’s imperative you have the home inspected thoroughly so no surprises surface down the road. If a home on HUD foreclosure listings is in need of repairs, you may qualify for an FHA 203(k) rehabilitation loan. These loans allow you to finance the cost of repairs and the home price in the same loan.

For the website links to REO listings of the five major bank systems, go to this article. It also provides links to other government agencies with REO properties for sale.

HUD foreclosure listings are free of charge. Other foreclosure websites may include HUD homes in their listings, yet charge you for the list. If you want to compare HUD homes with other REO properties in your area, get free real estate listings here.

Types of Foreclosure

judicial Foreclosure is available in all states and requires court supervision. The property is presented at auction for sale to the highest bidder by the sheriff or some other designated officer of the court, and the proceeds of the sale are applied first to satisfy the remaining mortgage debt, as well as the lender’s reasonable legal costs. If any monies are left over, they are typically applied to satisfy any junior lien-holders. Typically, the borrower is entitled to whatever is left, if anything, once all liens are satisfied.

Some investors routinely purchase properties at foreclosure sales operating under the assumption that institutional lenders are not in fact motivated to sell the property for any more than whatever amount that is pledged against it. For this reason, as a consumer protection measure, many states require a judicially supervised foreclosure in order to protect whatever remaining equity a borrower may have in the property should the value of the debt being foreclosed prove less than the actual market value of the property.

Deficiency Judgments

In a weakened real estate market it often occurs that foreclosed real property is sold for less than the balance that remains on the mortgage loan. If there is no insurance to cover the loss, many states permit a court to enter a deficiency judgment against the borrower to cover the unrecovered amount. This means that the borrower remains obligated to repay the difference between the auction price and whatever sum remains due on the mortgage loan, and the lender therefore is entitled to pursue other assets or monies available to the borrower.In some states, such as California, original mortgages (mortgage loans obtained at the time the real property was purchased) are declared non recourse loans, meaning that the lender has no right to pursue a deficiency judgment at all.

Acceleration Clauses

With an acceleration clause in a mortgage instrument, the lender can declare the entire remaining debt due and payable immediately upon default (in whatever way that term is specifically defined by the mortgage document). It is rare for any modern mortgage instrument not to include an acceleration clause, since without such language a lender must wait until all of the payments become due, unless the lender can convince a court, at the court’s discretion, to order the sale of portions of the real property in order to make up for past-due payments.