Google and the National Association of REALTORS published an incredibly insightful study in early 2013 named “The Digital House Hunt – Consumer and Market Trends in Real Estate.” According to their research concluded that both First Time Home Buyers and Repeat Home Buyers used the Internet for research and home searching for an average of 11 weeks before closing. The same homebuyers only contacted and began working with a licensed Real Estate Agent for three weeks before closing.

The good news is that potential homebuyers were educating themselves long before they felt they were ready to bring their dream of purchasing a home to reality. The bad news is, the internet is a vast ocean of information, most of which could be written by a virtual assistant hired by someone to publish content for an agent’s website. Where exactly does their information come from?

Who knows…

To get started buying a home one of the first steps is indeed RESEARCH. Research is key, but it’s important to choose your source of information very carefully. If your research knowledge conflicts with what your real estate agent tells you, this can cause confusion, unnecessary stress, and possible bad decisions that can impact a home buyer for the rest of their lives. Make sure you get your information from reputable sources, learn to compare and contrast the different sources. If one article doesn’t jive with another article about the same thing, keep searching. Seek out reputable websites who’s content follows suit.

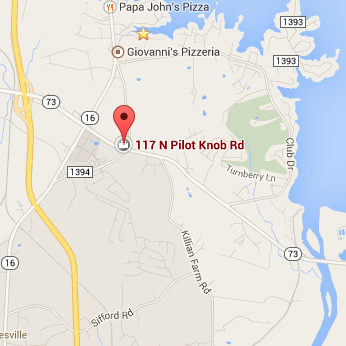

During your research, make sure to visit your local city’s GIS websites. Almost every city uses some sort of GIS mapping system to display public property information. Learn where to find property tax information, building permits, DEEDs, and other background information about real estate. Once you really start pounding the pavement searching all of your favorite homes, a smart homebuyer will work with their real estate agent to uncover as much information about a particular home as possible. Learn how to comfortably navigate through public records quickly. The information is out there, make sure you know how to get it.

Here are some links to the Charlotte/Lake Norman area GIS websites.

- Catawba County GIS:http://gis.catawbacountync.gov/parcel/

- Lincoln County GIS:http://www.lincolncounty.org/index.aspx?NID=289

- Iredell County GIS:http://iredell.connectgis.com/Disclaimer.aspx?ReturnUrl=%2fDisclaimer.aspx

- Gaston County GIS:http://egov1.co.gaston.nc.us/website/ParcelDataSite/WelcomePage.html

- Rowan County GIS:http://rowan2.connectgis.com/Disclaimer.aspx?ReturnUrl=%2fMap.aspx

- Mecklenburg GIS:http://polaris.mecklenburgcountync.gov/website/redesign/viewer.htm

If a potential homebuyer is thinking about purchasing a foreclosure, make sure to visit these key website and make sure to bookmark them for later.

- HUD Foreclosures:http://HudHomeStore.gov

- Fannie Mae Foreclosures:http://HomePath.com

Contact local mortgage lending companies, and ask questions. When you call these companies you will most likely reach the Mortgage Company’s Sales Representatives. Keep track of who you talk to and make sure to save their name, company name, phone number and website address for later. The objective right now is still research, choosing the ONE mortgage rep you want to work with isn’t the goal at this point. You should shop around for your mortgage loan. A smart homebuyer will shop for loans, compare lending options and make Mortgage Lending companies compete for their business.The Good Faith Estimate (GFE) is a loan worksheet that mortgage lenders will fill out with the details of the loan they are offering you. There is actually a page on this worksheet with spaces for three mortgage companies to write down the details of their particular loans. The Good Faith Estimate was made specifically for homebuyers, so they could quickly shop and compare features between competing mortgage companies.

Here are some good websites with more detailed information about the Good Faith Estimate, RESPA and other Home Mortgage Information.

- HUD (Housing and Urban Development)http://HUD.gov

- RESPA Info:http://portal.hud.gov/hudportal/HUD?src=/program_offices/housing/rmra/res/respa_hm

- North Carolina Finance Agency:http://www.nchfa.com

- Carolina Home Mortgage Programs:http://www.carolinahomeprograms.com